Purchased Office Furniture Journal Entry

Debit Furniture Credit Cashbank The furniture is an asset.

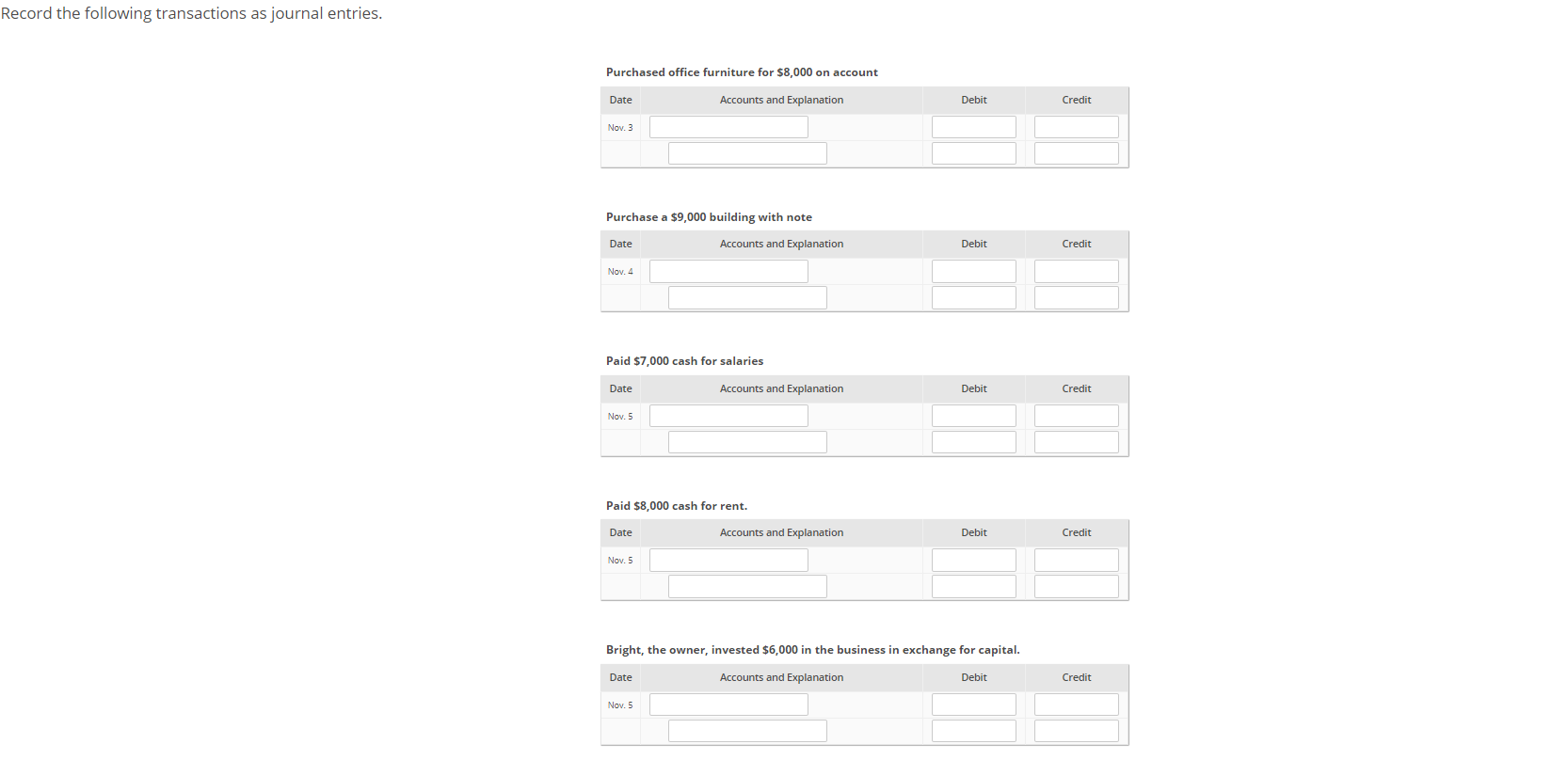

Purchased office furniture journal entry. Furniture is coming into the business therefore it will be debited and as cash is going out of the business it will be credited. 100000 Purchased from Sai Industries with GST12. Purchase Journal Entry Asset Purchased in Cash.

Amount Being Furniture purchased for Cash. A Debit equipment for Rs. Hashim Khan the owner invested Rs.

Aug 12 Air conditioner purchased for Rs 60000 by cheque. The person to whom the money is owed is called a Creditor and the amount owed is a current liability for the company. 10000 in Cash.

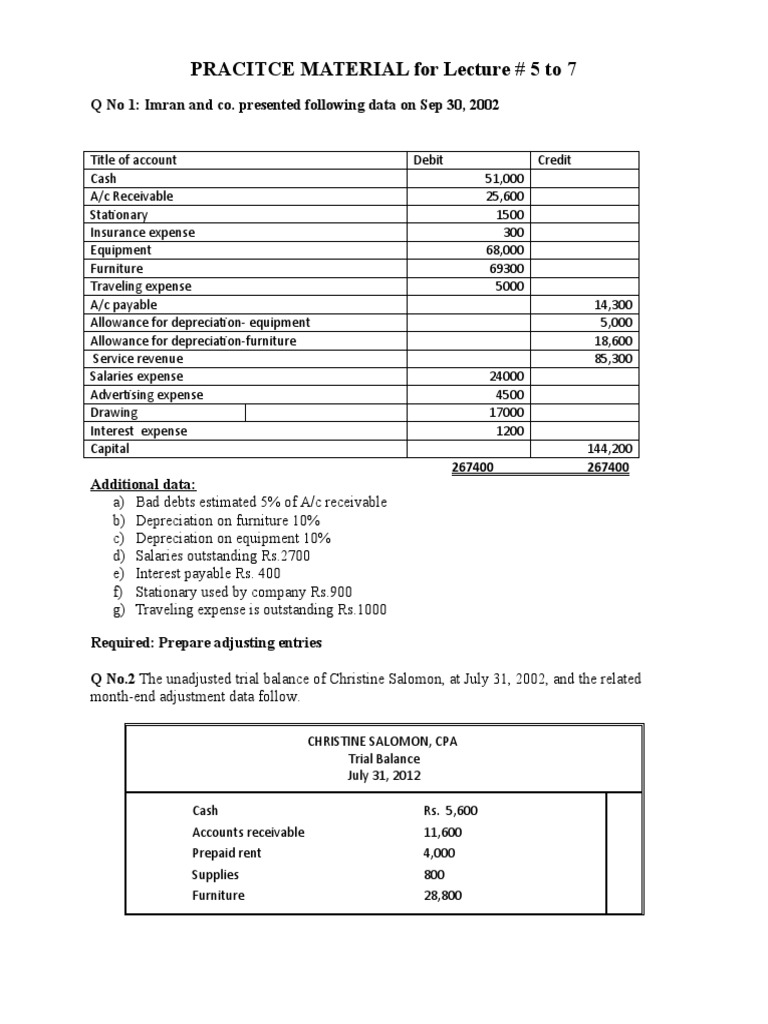

The accounting records will show the following purchased supplies on account journal entry. The journal entry is as follows. Prepare general journal entries for the following transactions of a business called Pose for Pics in 2016.

Prepare the general journal entry to record this transaction. 200000 and creditors Rs. 57500 cash and Rs.

Purchased goods for Rs. In case of a journal entry for cash purchase Cash account and Purchase account are used. Since filing cabinet is a form of office furniture and that the cartage is a direct expense associated with the same the entry would be Office Furniture Account Dr.